Financial

Statements

![]() Working with GSA’s bookkeeping services has allowed us to closely monitor the financial health of our company without hiring a full-time resource. GSA took the time to learn our business processes and how we manage our ” projects. I would highly recommend them!

Working with GSA’s bookkeeping services has allowed us to closely monitor the financial health of our company without hiring a full-time resource. GSA took the time to learn our business processes and how we manage our ” projects. I would highly recommend them!![]()

Lenny Berger

Chief Mensch

The Handy Mensch

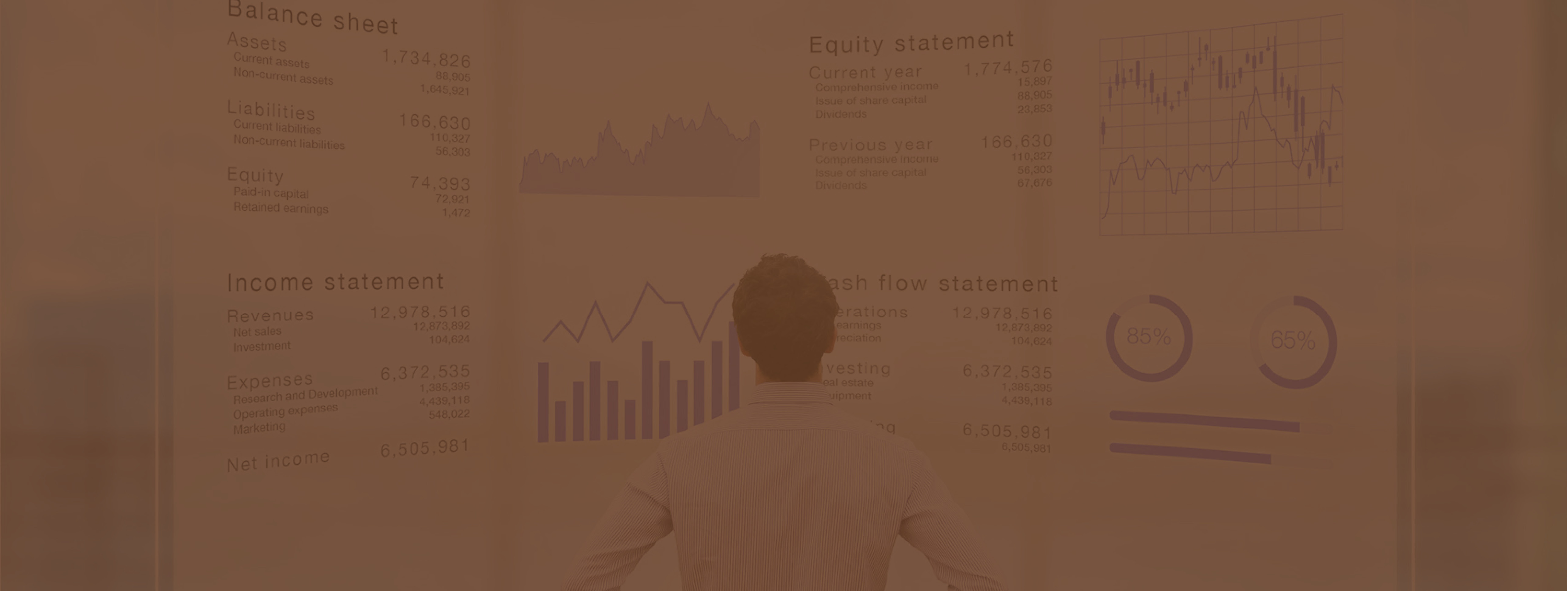

Financial Statements

Investors need to know how a company is doing financially before they decide to invest – or not. Your Financial Statements need to give an investor an overview of the profitability, potential for growth, strengths, and weaknesses in your business. Here are 4 Ways to Improve Your Financial Statements.

1. Consider the format of your financial statements.

Providing investors with easy-to-read financial information in the financial statements is essential to achieving your objective of capable, confident, and well-informed investors.

2. Make sure to include an operating and non-operating presentation.

It is important to consider the effects of both operating and non-operating components of the income statement.

3. Review peer organizations’ financial statements for best practices.

A review of other organizations’ financial statements is a great place to start when updating your own.

4. Modify your footnotes.

Financial statements are easier to read and understand when you identify what information is relevant to your investors, prioritize it appropriately, and present it in a clear and simple manner. In some cases, this includes additional information that is useful for investors and, in other cases, removing information that is immaterial.

Financial statements are intended to provide investors with information that is useful for making investment decisions. These statements need to be updated annually and should be prepared in accordance with U.S. Generally Accepted Accounting Principles (GAAP).

What Should Your Financial Statements Include?

There are different types of financial statements that you will need to prepare, including a balance sheet, income statement, and statement of cash flows.

The Balance Sheet

The balance sheet will tell an investor how your business funds assets, which can be through a liability such as debt or stakeholders’ equity or such as extra capital that was paid to your business or retained earnings. The liabilities that you will need to list in your balance sheet include debt, rent, tax, utilities, payroll, and dividends payable.

• Assets = (Liabilities + Owner’s equity)

The Income Statement

Some of the types of revenue that you will include in your income statement include interest that your business earns on cash that is in the bank, income from strategic partnerships, income from advertisement displays that are on your property, and rental income from property, for example.

•Net Income = (Revenue – Expenses)

The Statement of Cash Flow

The statement of cash flow shows how your company is managing the inflow and outflow of cash within the business. There isn’t a formula to calculate a cash flow statement, but there are three sections that report the cash flow into your business, namely:

• Operating activities,

• Investing activities, and

• Financing activities.

Financial Statements for Non-profits and Small Business

We provide financial statements essential for non-profits and small business including:

Compilations

A compiled financial statement that is a “representation of management”

Reviews

Involving analysis of financial statements combined with inquiries with the management team

Audits

The highest level of confidence through methodical review, verification of information and objective examination.

Complete Tax Planning and Preparation Services

Creating financial statements can seem tedious and complicated, but preparing these documents is a vital part of planning for the year ahead. Financial statements make up a large part of the projections and planning for your business’s future and can give you strategic guidance on crucial changes to make to ensure sustained success.

Would you like more information?

Call us at (703) 319-3990 or email us at kathy@gsacpa.com today to learn more about what we can do for you.

Our Services

Quickbooks Advisor and Payroll Services

![]()

Quickbooks training,

analysis and tune-

up as well as Initial

registration and setup,

quarterly and annual

and federal and state

reporting and payroll

preparation

Tax Preparation

![]()

75% of 71 million

taxpayers say they

benefitted from using

professional tax

preparation

Accounting for Government Contractors

![]()

Generate government

invoices, produce

year-end financial

documents and more

Quickbooks Advisor and Payroll Services

![]()

Quickbooks training,

analysis and tune-

up as well as Initial

registration and setup,

quarterly and annual

and federal and state

reporting and payroll

preparation

Tax Preparation

![]()

75% of 71 million

taxpayers say they

benefitted from using

professional tax

preparation

Accounting for Government Contractors

![]()

Generate government

invoices, produce

year-end financial

documents and more