Energy tax credits offer an excellent opportunity for DIY individuals and homeowners to save money while reducing their environmental footprint. These incentives, provided by governments, aim to promote energy-efficient improvements in homes and properties. The good news is that you can often tackle many of these projects yourself to maximize your savings. Here are some common examples of energy-efficient upgrades that may qualify for tax credits:

Solar Panels:

Installing solar panels on your property to generate electricity from sunlight is a common and widely recognized way to qualify for energy tax credits. This can include both solar photovoltaic (PV) systems for electricity generation and solar thermal systems for water heating.

Energy-Efficient Windows and Doors:

Upgrading to energy-efficient windows and doors that meet specific energy performance criteria, such as ENERGY STAR certification, may qualify for tax credits. These improvements help reduce heat loss and gain in your home, leading to lower energy consumption.

Insulation:

Adding insulation to your home to improve its energy efficiency can often be eligible for tax credits, and is one of the more cost-efficient ways of improving your home’s heating and cooling capabilities, all while getting tax credits. Properly insulated homes are better at maintaining consistent indoor temperatures and reducing the need for heating and cooling.

High-Efficiency HVAC Systems:

Replacing or upgrading your heating, ventilation, and air conditioning (HVAC) system with high-efficiency models that meet specific energy efficiency standards may qualify for tax credits. This includes furnaces, air conditioners, heat pumps, and boilers.

Small Wind Turbines:

In some regions, installing small wind turbines on your property to generate electricity can be eligible for tax credits. These turbines harness wind energy and convert it into usable electricity. They can also be found at certain retailers or online.

Energy-Efficient Appliances:

Purchasing energy-efficient appliances that meet specific criteria may qualify for tax credits. These appliances often have the ENERGY STAR label and consume less energy than standard models.

Energy Audits:

In some cases, the cost of an energy audit to assess your home’s energy efficiency and recommend improvements may also be eligible for tax credits.

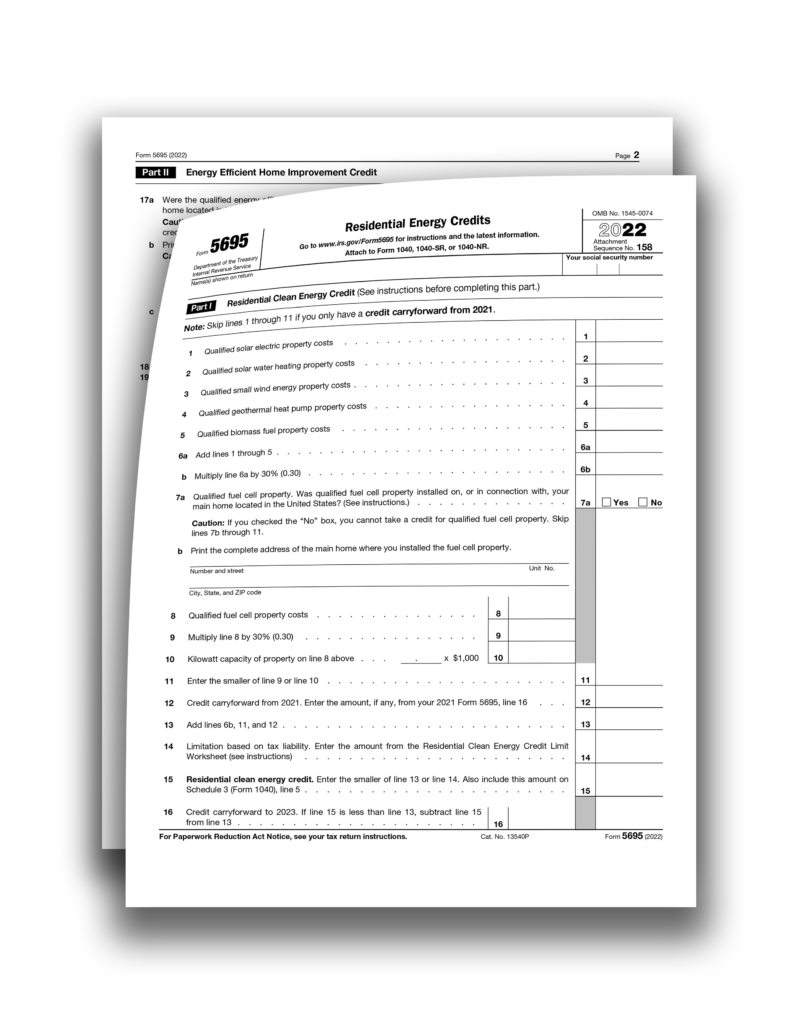

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation:

2022: 30%, up to a lifetime maximum of $500

2023 through 2032: 30%, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have a separate annual credit limit of $2,000), no lifetime limit.

Conclusion:

Take advantage of these energy tax credits by tackling these DIY projects. Remember that eligibility criteria, maximum credit amounts, and application processes can vary by location and specific tax credit programs. Consult with Georgen Scarborough Associates and keep meticulous records of your energy-efficient improvements and expenses. Stay informed about any changes in tax laws and incentives to ensure you make the most of these opportunities.

For more information on how to outfit your home to receive 2023 – 2032’s Home Energy Tax Credits, contact Georgen Scarborough Associates at (703) 319-3990 or through their website at gsacpa.com.

Source: Energy.gov, IRS.gov

Visit the Energy.gov site for more information:

Making Our Homes More Efficient: Clean Energy Tax Credits for Consumers | Department of Energy

Visit the IRS.gov site for more information:

Home Energy Tax Credits | Internal Revenue Service (irs.gov)

Energy Efficient Home Improvement Credit | Internal Revenue Service (irs.gov)